catalysts of change

Thought of the Week – 26th January 2026 (2)

Thought of the Week – 19th January 2026

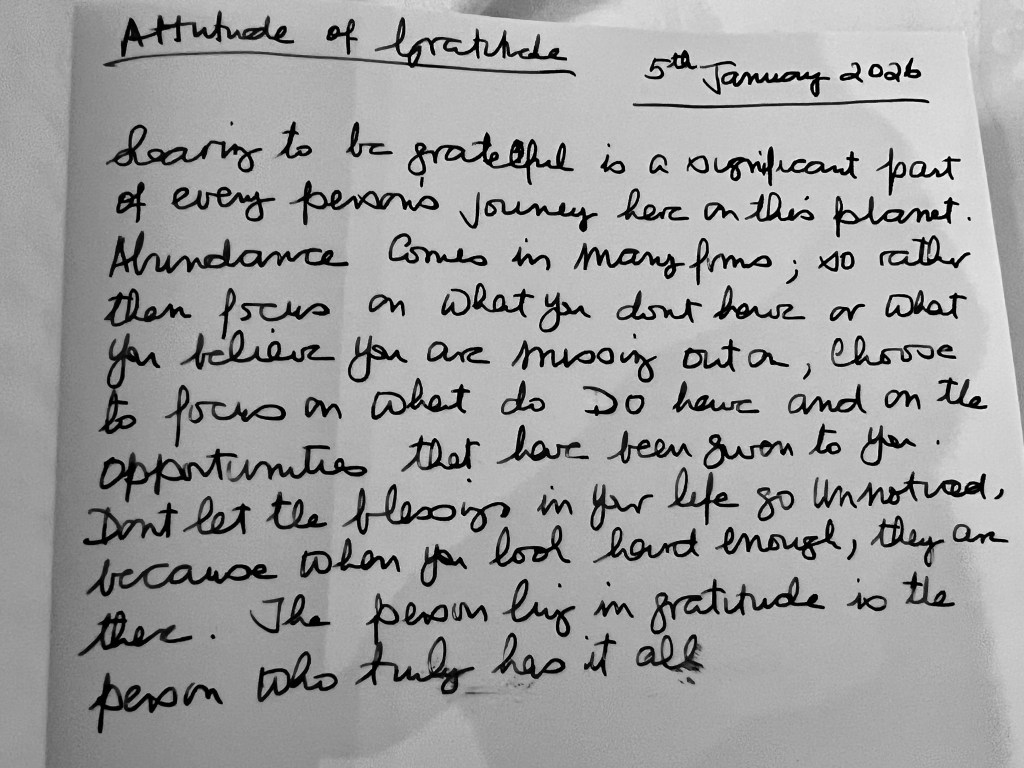

Note to Myself – Attitude of Gratitude

Thought of the Week – 5th January 2025

Dance so Totally that there is only the Dance and no Dancer….

Thought of the Week – 8th December 2025 (3)

Thought of the Week – 24th November 2024 (2)

Thought of the Week – 24th November 2025

Prayer and Worry

As a daily discipline for at least a week, take time for prayer. Some days it may be for only a minute or two; on other occasions it may be for more lengthy periods. Experiment with the four types of prayer:

Confession: Recognizing and admitting, without guilty feelings, the current state of your life

Thanksgiving: Expressing appreciation for the blessings of your life

Petition: Out of the spirit of your highest ideal, asking for what you feel you need

Praise: Communicating the wonder and awe you feel when you consider the Creator.

By the end of the week, notice whether you can observe any changes in the amount of time and energy you spend on worrying.

Mark Thurston Phd and Christopher Fazel

The Edgar Cayce Handbook for Creating Your Future